Before applying a mortgage loan program, your clients need to pass several requirements. All the requirements need to be completed and it is one step closer to the approval. On the other hand, as the mortgage officer you also need to check their requirement and make sure that they pass all of them.

It will be complicated if you have to take a note especially if you have hundred of clients. It is better for you to take mortgage application checklist to help you. This checklist template makes the identification and approval faster and simpler than before. As simple as that and your job is easy and you don’t need to spend more time to take a note. You just change the note with the checklist sign. Moreover, you can classify between the clients who pass the requirements and the clients who don’t pass the requirement based on the mortgage application checklist template. Of course, it increases the satisfaction sense for your client because the approval process is faster than the other loan program and the chance to get the mortgage is bigger.

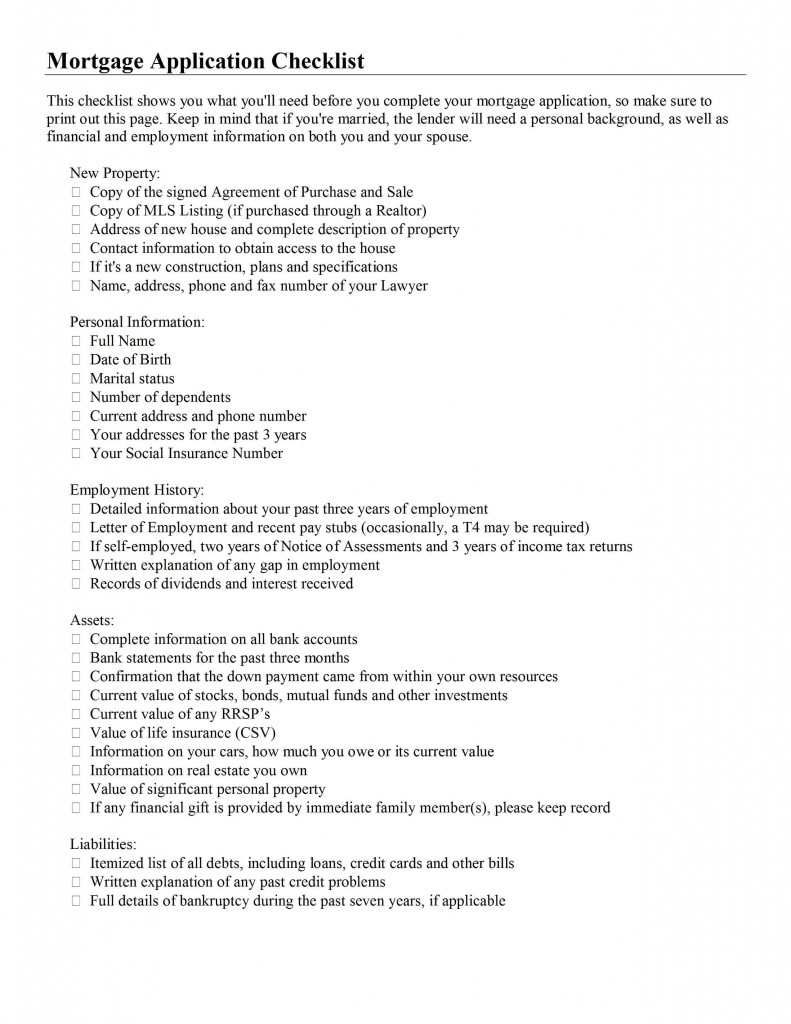

There are two columns presented there which are the item column and checklist column. In the item columns will be stated the requirements if someone want to apply a mortgage loan program. ID card, tax ID, and payroll slip become three examples of items which they need to give to you. You just check the items mentioned above and if the items are complete it means you just need to give the checklist on the checklist column. You can customize it to suit your company’s need because your bank/company requirement should be different than requirement in this template.

[wpdm_file id=289]